New business owners, or those who outsource their accounting, can sometimes confuse gross profit and net profit. Both are important indicators of business performance and appear on your income statement, but there are critical differences between the two values. As a small business, it’s crucial to understand what each means, as this could affect your pricing strategy, production methods, operating model, and other key decisions.

Fleximize’s financial controller, Elizabeth Tansley, has outlined her simple explanation of the difference between gross and net profit for business owners and how to report both metrics in your financial statements.

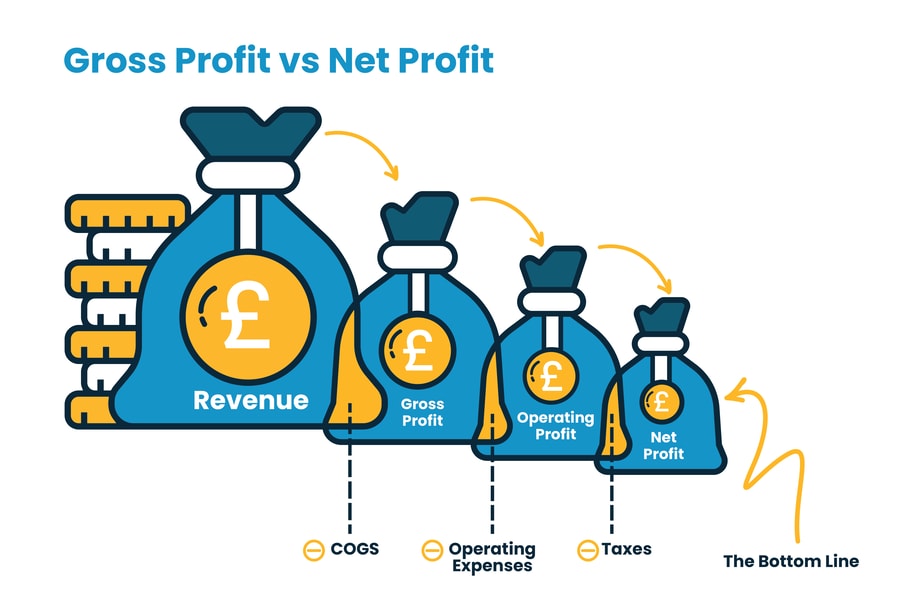

Gross profit and net profit are two key metrics in your income statement, but they show very different things.

- Gross profit shows how much money you make from sales after subtracting the direct cost of producing your goods or services.

- Net profit is your bottom line — it accounts for all expenses, including rent, payroll, and taxes, not just the cost of production.

Both are vital for understanding your business performance, setting prices, and attracting funding — but they are not interchangeable.

What’s the difference between gross profit and net profit?

Gross profit is the money generated by sales after the cost of producing the goods or services has been subtracted.

Net profit accounts for these too, but also includes operating costs and other overheads, like payroll, utilities, and rent.

Metric | Includes | Excludes |

Gross Profit | Revenue minus cost of goods sold (COGS) | Operating expenses, overheads |

Net Profit | Revenue minus all costs (COGS + overheads) | Nothing – it’s the final figure |

- Gross profit = Total sales – Cost of goods sold

- Net profit = Total sales – (COGS + operating expenses + overheads)

These figures help you assess both the profitability of your products and the overall financial health of your business.

What is gross profit?

Gross profit is the money left over from sales after subtracting the direct cost of producing those goods or services. It's often referred to as the money your business earns before overheads.

How to calculate gross profit

Use this simple formula:

Gross Profit = Total Sales – Cost of Goods Sold (COGS)

COGS typically includes:

- Raw materials

- Packaging

- Direct labour

What does gross profit show?

Gross profit helps you:

- Evaluate the profitability of individual products or services

- Identify if you need to reduce production costs or increase prices

- Track production efficiency

A high gross profit doesn’t always mean strong business performance. If your overheads are too high, your net profit could still be low or negative.

How to improve your gross profit margin

If your gross profit margin is too low, try these tactics:

- Review supplier costs: Can you negotiate better rates or buy in bulk?

- Increase prices carefully: A slight price rise, if justified by value, can boost profits.

- Streamline production: Find efficiencies in how you deliver products or services.

- Focus on high-margin products or services: Prioritise offerings that bring in more profit.

What is net profit?

Net profit is the total amount of money your business keeps after subtracting all expenses. This includes:

- Cost of goods sold

- Rent

- Utilities

- Payroll

- Taxes and interest

How to calculate net profit

Use this formula:

Net Profit = Total Sales – (COGS + Operating Costs + Overheads)

For example, a jewellery retailer makes:

- £200,000 in sales

- Pays £130,000 to suppliers (COGS)

- Has £40,000 in overheads

Gross profit = £70,000

Net profit = £30,000

What does net profit show?

Net profit is your “bottom line.”

It indicates whether your business is financially sustainable and is the figure most investors and lenders will focus on.

How to improve your net profit margin

Boosting your net profit margin could involve:

- Cutting unnecessary costs: Review overheads like subscriptions, rent, and utilities.

- Improving cash flow management: Avoid late payment fees and take advantage of early payment discounts.

- Managing tax obligations: Ensure you're claiming all eligible deductions.

- Diversifying income: Explore additional revenue streams, like upsells or new products.

Profit margins explained

Many businesses will use profit margin calculations to assess their performance, as well as other key performance indicators (KPI). Thankfully, it's not too difficult to calculate your gross profit margin and net profit margin.

- Gross Profit Margin = Gross Profit ÷ Total Sales

- Net Profit Margin = Net Profit ÷ Total Sales

Margins help you:

- Benchmark business performance

- Compare profitability year-on-year

- Show investors the health of your business model

With a good understanding of gross and net profit, you can assess how your business is performing over time.

Tracking your gross profit, for example, will help you to spot any changes in the efficiency of your production lines, issues with product pricing, or weaknesses in management. Additionally, net profit enables you to justify your business model, forecast growth, and instil investors with confidence that your business will be a success.

This article is for general guidance only and does not constitute legal or financial advice. Speak to an accountant or financial advisor for support with your specific situation.

Your common questions answered

Gross profit only includes revenue minus production costs (COGS), while net profit subtracts all business expenses, including rent, wages, and tax.

Gross profit shows earnings after direct costs. Net profit is what’s left after all costs are deducted.

It helps you price products, manage costs, and prove your profitability to investors or lenders.

Both matter, but net profit gives a clearer picture of your overall financial health.

As a business, you're generally taxed on your net profit, not your gross profit. Net profit reflects your income after all allowable expenses have been deducted — this is the figure used to calculate your Corporation Tax or Income Tax (if you’re a sole trader).

Do you have a question that you can't see? Check out our FAQ page.

These cookies are set by a range of social media services that we have added to the site to enable you to share our content with your friends and networks. They are capable of tracking your browser across other sites and building up a profile of your interests. This may impact the content and messages you see on other websites you visit.

If you do not allow these cookies you may not be able to use or see these sharing tools.